Yes, Time is Everything

Time In The Market Has Proven Better Than Trying To Time The Stock Market

The recent market volatility brought on by COVID-19 has been unsettling to investors as the way forward has become more uncertain and in some cases, changed daily. Recent market volatility has been both dramatic on the downside, with the S&P positing its fastest peak to trough decline ever (2/19/20-3/22/20), as well as on the upside, with the Dow Jones Industrial Average posting its best one day (3/22/20) since 1933. Market volatility, in fact, cuts both ways.

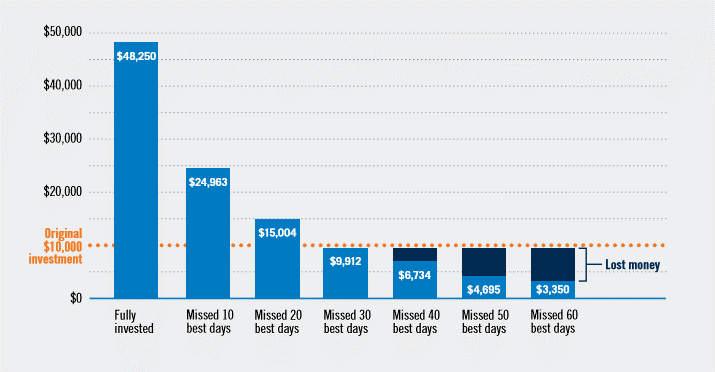

The saying goes, timing is everything, but not in the stock market. In the stock market, time is everything. More specifically, your time in the stock market, or how long you stay invested, is everything. Timing the stock market is extremely hard to do, even for the most sophisticated investors. Inevitably, trying to time the stock market means being out of the stock market for some length of time. The chart below examines how missing some of the best days in the stock market over a 20-year period (1995-2015) can impact an account balance. As it turns out, an investor who stayed in the market for the full 20 years would have seen the highest account balance. Investors out of the market and missing the market’s best days all would have underperformed the investor who stayed fully invested over the full 20 years, which includes the 2008-2009 financial crisis.

For long-term retirement plan participants, research has shown it is generally not wise to try and time the markets. It is extremely hard to time the market’s recovery. Even in bear markets it is wise to “stay the course” amid the uncertainty and market volatility. COVID-19 and the resulting containment procedures enacted as a result will pass, allowing investors again to re-focus on the real market drivers like corporate earnings and growth. It is important to keep in mind that current market conditions rarely provide a clear direction as to the future performance of the markets.

The U.S. market in particular has been dynamic and resilient in moving on from crisis after crisis throughout history. The recent market volatility should remind plan participants to focus on what they should be doing on a regular basis: Be mindful of the situation, but diligent about your long-term investment strategy and goals. Participants need to act in their own best interests while the stock market reacts to current events and the uncertainty it brings. Your time in the market (and not trying to time the market) is often the best course of action.

Sources: Prudential

Chart Assumptions: $10,000 invested in S&P 500® index from Dec. 31, 1995 through Dec. 31, 2015, with dividends reinvested and excluding returns from “best performing days” where noted. Chart is for illustration only; you cannot invest directly in an index.

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by KerberRose Wealth Management, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Comments concerning the past performance are not intended to be forward looking and should not be viewed as an indication of future results.