Beautifully Frugal: Things To Consider Before Buying A Home

Achieving homeownership is a significant milestone, but it also comes with substantial responsibilities compared to renting. These responsibilities can range anywhere from simple home maintenance and lawn care up-keep to significant obligations such as paying for a mortgage, property taxes, and homeowner taxes. Buying a home should be an exciting and rewarding experience, not a stressful one. In this month's blog, we’ll explore crucial factors to consider before taking the leap into homeownership to help ensure you are well-informed for your home-buying journey.

Your Mortgage: How much can you actually afford?

One of the most crucial considerations is your mortgage. While mortgage companies may approve you for a certain amount, it’s essential to determine how much you can comfortably afford to spend on your monthly payment. A general rule of thumb is to allocate no more than 30% of your take-home pay towards your mortgage payment. This allows you to maintain a balanced lifestyle, invest in your future, and enjoy life’s pleasures without stretching your finances too thin.

To help you visualize and calculate your potential mortgage payment, consider using a mortgage calculator. You’ll be able to input your desired home price, down payment amount, interest rate, and loan term, and the calculator will estimate your monthly mortgage payment. Using this mortgage calculator, you can experiment with different scenarios and find the sweet spot where your monthly mortgage payment aligns with your financial comfort zone.

By taking the time to understand your mortgage affordability and playing around with the calculator, you can make an informed decision and ensure that your mortgage payment fits comfortably within your budget, allowing you to enjoy the benefits of homeownership without sacrificing your financial well-being.

2. Uncover Hidden Expenses Such as Utility Costs

Another important consideration is the cost of utilities in the area where you are looking to buy. Unexpectedly high utility bills can put a strain on your finances, so it's best to do your research beforehand. Contact local utility companies and inquire about average utility costs in the area you're interested in. Additionally, many utility companies offer budget billing, which spreads the cost of your utility bill evenly over a year, eliminating monthly fluctuations and providing consistent bills.

If you live in Wisconsin or Michigan you can contact Wisconsin Public Service (WPS) for a utility cost estimate. Although there are many factors which can influence your total costs, it’s beneficial to include as much information about the residence/business as possible, such as location/site.

By taking time to research your area’s utility costs, you’ll be better prepared to budget for these essential expenses and avoid any unpleasant surprises after moving into your new home. Don’t let hidden utility costs catch you off guard – take control of your homeownership journey by doing your research and planning ahead!

3. Create a Mock Budget!

After determining your hypothetical mortgage payments and estimated utility spend for your area, create a mock budget to assess the impact on your finances and lifestyle. Factor in wiggle room for personal enjoyment, savings towards future financial objectives, and unexpected expenses.

This exercise will help you determine the true amount you can comfortably afford for your mortgage payments. You are the expert on your household, so use this opportunity to tailor your budget to suit your needs and preferences!

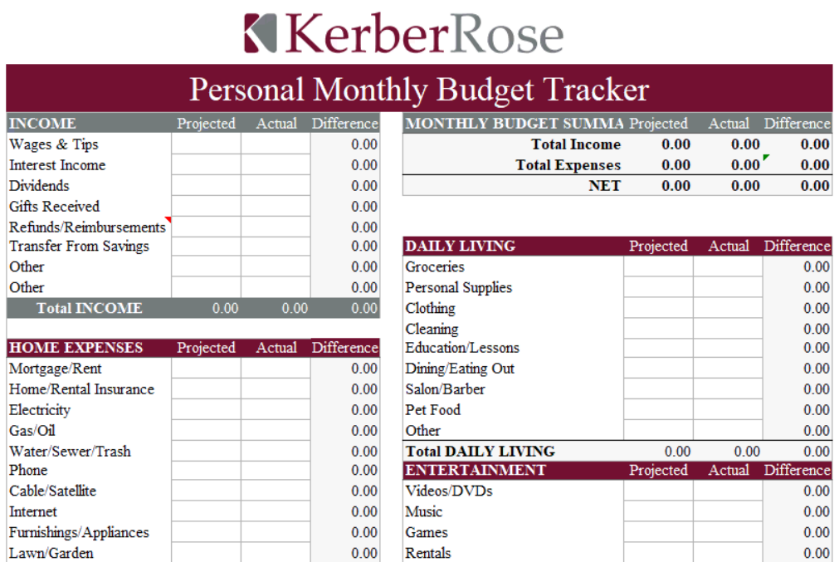

Unsure how to get started on building out your budget? Download our smart Personal Monthly Budget Tracker. This comprehensive Excel sheet works with you to create a realistic mock budget of all of your expenses. Try it out!

4. Grow your Emergency Fund

As a homeowner, you’ll be responsible for all major repairs and maintenance costs, so having a cushion to cover these expenses is crucial. By growing your emergency fund before buying a home, you’ll be able to avoid financial stress when unexpected expenses arise — and let me tell you, they will arise when you least expect them! Aim to have at least three to six months' worth of living expenses saved up to cover any unforeseen repairs or emergencies, such as a broken heater in the middle of winter.

5. Embrace DYI Possibilities

When considering buying a home, create a list of must-have features and items you’d be able to upgrade or add later. Homes which require some compromises tend to be more affordable. For example, a home with an unfinished fenced-in yard, kitchen, or basement may have a lower price, giving you more flexibility in your budget.

Determine which compromises you’re willing to make and which upgrades are non-negotiable before making a purchase. Communicate your priorities clearly with your realtor, and keep them updated if your criteria change during the search process.

One way to embrace the potential of a “fixer-upper” is to tap into the DIY space available on social media platforms like TikTok and Instagram. These platforms are treasure troves of creative and cost-effective home improvement ideas, tutorials, and inspiration!

On TikTok and Instagram, you can find countless videos showcasing DIY projects for every room in the house, from budget-friendly kitchen renovations to backyard transformations. Follow hashtags like #DIYHomeRenovation, #HomeImprovementTips, and #DIYOnABudget to discover a world of possibilities.

Purchasing a home is a significant investment, and being well-prepared is crucial to make it an enjoyable experience. Begin your home buying journey on the right foot by conducting thorough research, understanding what you can comfortably afford, and seek guidance from our Trusted Advisors. Our committed team is available to help you achieve your financial objectives and cheer you on along the way.